6 Free Payroll Tax Calculators for Employers in 2020 purshoLOGY

INCOME TAX CALCULATOR UPDATED 2023 CLICK HERE TO REGISTER INCOME TAX FOR SPANISH RESIDENTS INCOME TAX FOR NON SPANISH RESIDENTS HOW IT WORKS 1.- READ THE TAX INFORMATION RELATED TO BOTH TAXES (FOR RESIDENTS/NON RESIDENTS) You will find plenty of information about Income Tax for Residents and not Residents in this site.

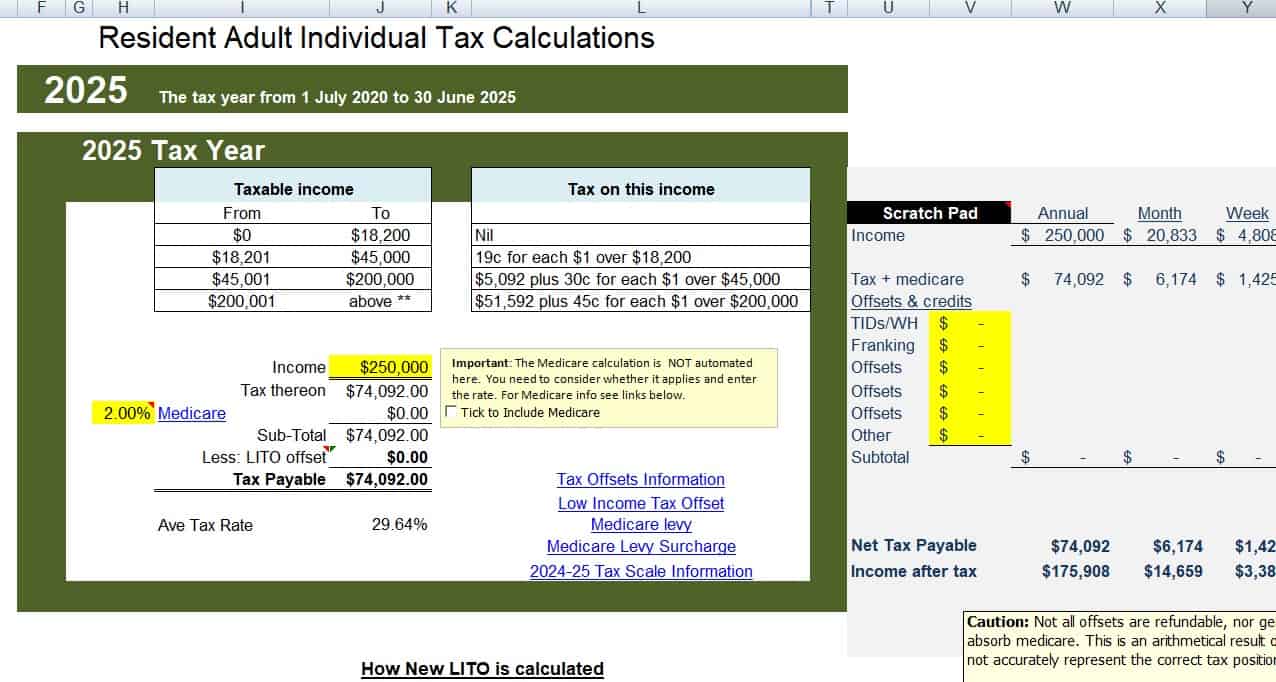

Tax Calculator atotaxrates.info

In Entre Trámites you can find several calculators that will allow you to easily estimate the information you want to obtain, such as your net self-employed salary, the income tax you must pay or other taxes that apply to you. Easy to use (with built-in explanation) With up-to-date information. With a wide variety of options depending on your.

Tax Calculator McCracken County PVA Bill Dunn

Calculate Your Take-Home Pay Salary Calculator Results If you are living in Spain and earning a gross annual salary of €21,876 , or €1,823 per month, the total amount of taxes and contributions that will be deducted from your salary is €4,056 .

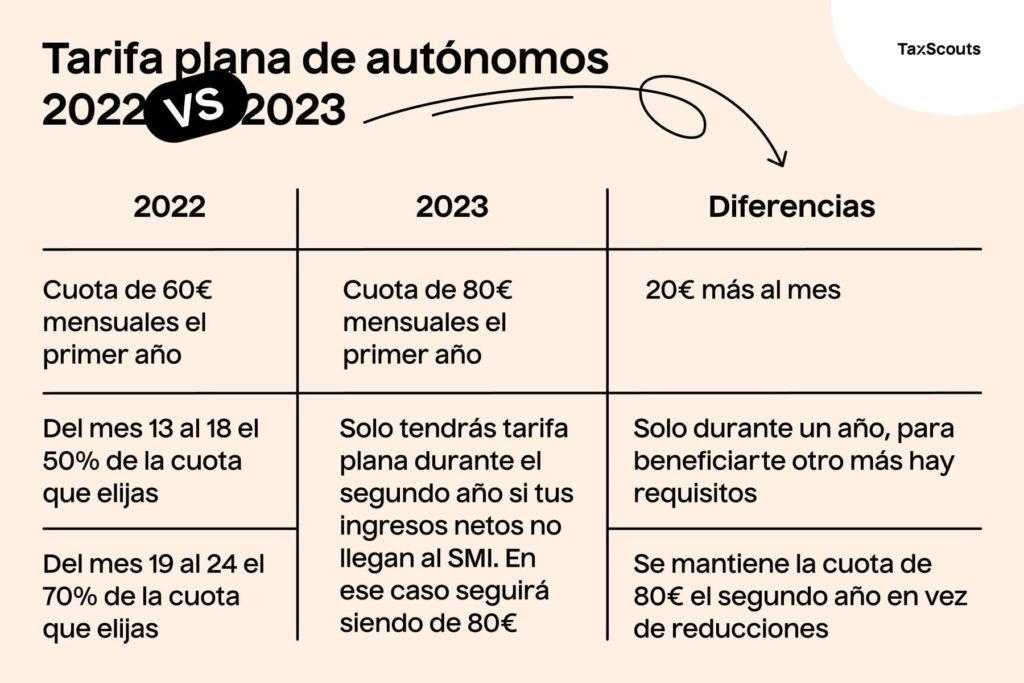

Estas son todas las ayudas para autónomos de Madrid en 2023 TaxScouts

Esta calculadora de sueldo neto de autónomo te dará solamente un resultado aproximado. Aunque los datos que introduzcas sean 100% exactos, puede que tu sueldo neto mensual o anual de autónomos no cuadre al céntimo, porque hay un montón de factores que influyen en el resultado final. Tu situación Quiero saber mi sueldo Mensual Anual

Digital TDS Calculator Easy and Accurate Employee Tax Calculations

#Guide: Autonomo Tax Calculator 📑 If you are considering becoming self-employed in Spain, then this guide is for you!We include here more than 20 different situations to help you calculate an.

Best Tax Calculators Contact Tax Consultants

While employees will be able to access an annual personal income tax deduction of up to €10,000 with the joint deduction of employment plans (€8,500) and individual plans (€1,500), the self-employed will only have an annual deduction of €5,750. BBVA bank offers an English-language tax calculator for private pension plans in Spain.

Tax Calculator to Estimate Tax Refund

The Arles Estate Info. THE ARLES is located in Sha Tin District (Address: 1 AU PUI WAN STREET, HMA: Fo Tan). The Date of Occupation starts from 2022.12.31. There are a total of 4 blocks, providing 1335 residential units. The saleable area of THE ARLES ranges from 228sq.ft. to 2001 sq.ft. Primary One Admission School Net for THE ARLES is 91.

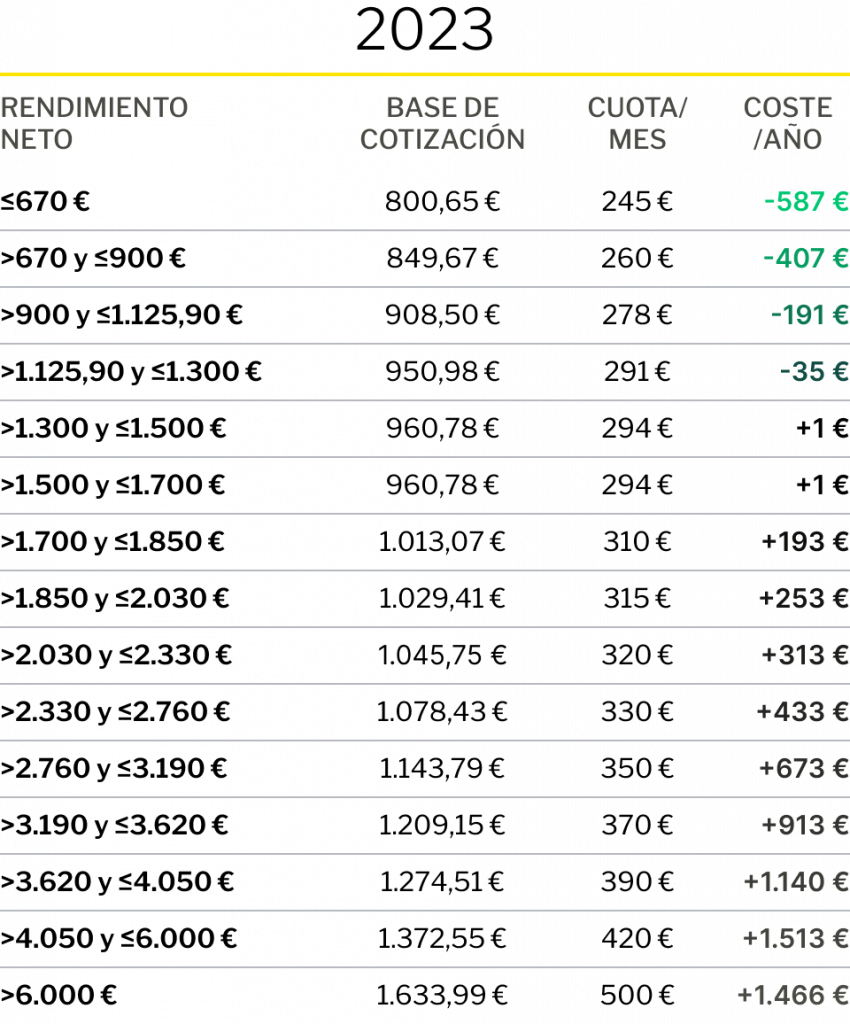

Nuevas Cuotas de Autónomos 2023, 2024 y 2025 AyS

1. Common contingencies: 28.30%. 2. Professional contingencies: 1.3%. 3. Cessation of activity: 0.9%. 4. Continuous training: 0.1%. The sum of the 4 percentages is equal to the 30.6% that we talked about before, which means a minimum fee for self-employed workers of €294 (€960.60 x 30.6%).

Amt Tax Calculator Excel » Veche.info 24

1. Autonomo spain - tax returns. Autonomos (sole-traders) in Spain must make quarterly and annual income tax and VAT (known as IVA in Spain) returns. This will require the maintenance of records of all bills and invoices, with VAT receipts and payments noted separately. A Spanish accountant will then use this information to fill in the relevant.

La tarifa plana de autónomos en 2023 TaxScouts

Let's explore the 3 big taxes that any freelancer must pay in the country after becoming an "autónomo": Income tax or IRPF ("Impuesto de la Renta de las Personas Físicas") Provided that you are a freelancer in Spain who spends more than 183 days per year in the country, you will become what is called a tax resident.

¿Cómo hacer una factura de autónomo?

Different Situations: Autonomo tax calculator 1. Single without children. Annual volume: €20,000 2. Single with no children. Annual volume: €40,000 3. Single with no children. Annual volume: €60,000 4. Single with no children. Annual volume: €80,000 5. Single with 1 child. Annual volume: €20,000 6. Single with 1 child. Annual volume: €40,000

TAX CALCULATOR FOR FY 2021

An online calculator to compare the tax burden of self employed people in the UK and Spain. IMPORTANT! This was created in 2014. You are able to edit the rates in the fields below yourself to reflect the current tax laws if you wish, but I make no guarantees that any of the calculations or advice below is still relevant.

Tax Calculator Step wise Process to Use Calculator

Spain's Social Security system has created an online calculator tool that allows you to work out how much you should pay based on your estimated income, plus see the range of different monthly payments you could choose to make based on your contribution base. You can find the calculator here, and The Local has put together a guide on how to use it.

Obligaciones fiscales de los autónomos en 2021 Asesor Fiscal Barcelona Jesus Rey

The calculation of the annual amount to be paid is carried out at the beginning of the year and each quarter the entrepreneur pays a percentage of it in advance. In this way, the self-employed person pays the same amount of VAT every quarter regardless of invoicing.

2021 Self Employment Tax Calculator

1) Apply for a tax rebate (if you overpaid.) OR 2) Make an extra tax payment, if needed. YOUR GLOBAL TAX RATE The variable rates applicable to the taxable amount resulting from all your personal and business matters(after allowances and deductions are computed) can be seen in the tables below.

Fica withholding calculator TatumJolene

[GET] "https://admin.expatica.com/es/wp-json/wp/v2/yoast-redirects?origin=/finance/taxes/freelance-tax-spain-471615/":